You’ve been paying rent on time for months. Maybe years.

Gold star. Adulting medal. Standing ovation.

But here’s the kicker: those on-time payments aren’t really doing much for you—other than keeping your landlord happy and your Netflix streaming. In the eyes of the credit world? Crickets. Nada. Zero.

That’s where back reporting swoops in like the superhero your credit score didn’t know it needed.

Wait, What’s Back Reporting?

Think of it as giving your past self a little credit—literally.

Back reporting takes your rent payments from the last 24 months and retroactively reports them to the credit bureaus. That means all those months of paying on time (and let’s be real, sometimes sacrificing avocado toast for it) can actually show up on your credit report.

So instead of your rent money disappearing into the black hole of “just another bill,” it starts working for you1

Why Is This a Big Deal?

35% of your credit score = payment history. Rent is the biggest payment you make each month. If it’s not showing up, you’re missing out.

Back reporting makes your past behavior count. It’s like finally getting credit for going to the gym last year.

Lenders, credit card companies, even future landlords love to see a strong history of on-time payments. Back reporting helps you flex that.

Imagine This Scenario

You’ve been living in the same apartment for two years, never missed a rent payment, and your landlord’s dog waves its tail every time it sees you. But your credit report? Still acting like you’ve been living under a rock.

Back reporting is the “hello, did you forget about me?” moment that gets those 24 months of rent onto your credit file, showing the world you’re not just responsible—you’re reliably responsible.

Why Let Your Rent Go Unnoticed?

Rent is often your largest monthly expense. Why let it vanish into the financial abyss when it could be building your future? Back reporting transforms your rent from a silent expense into a loud-and-proud credit booster.

Make Rent Work FOR You

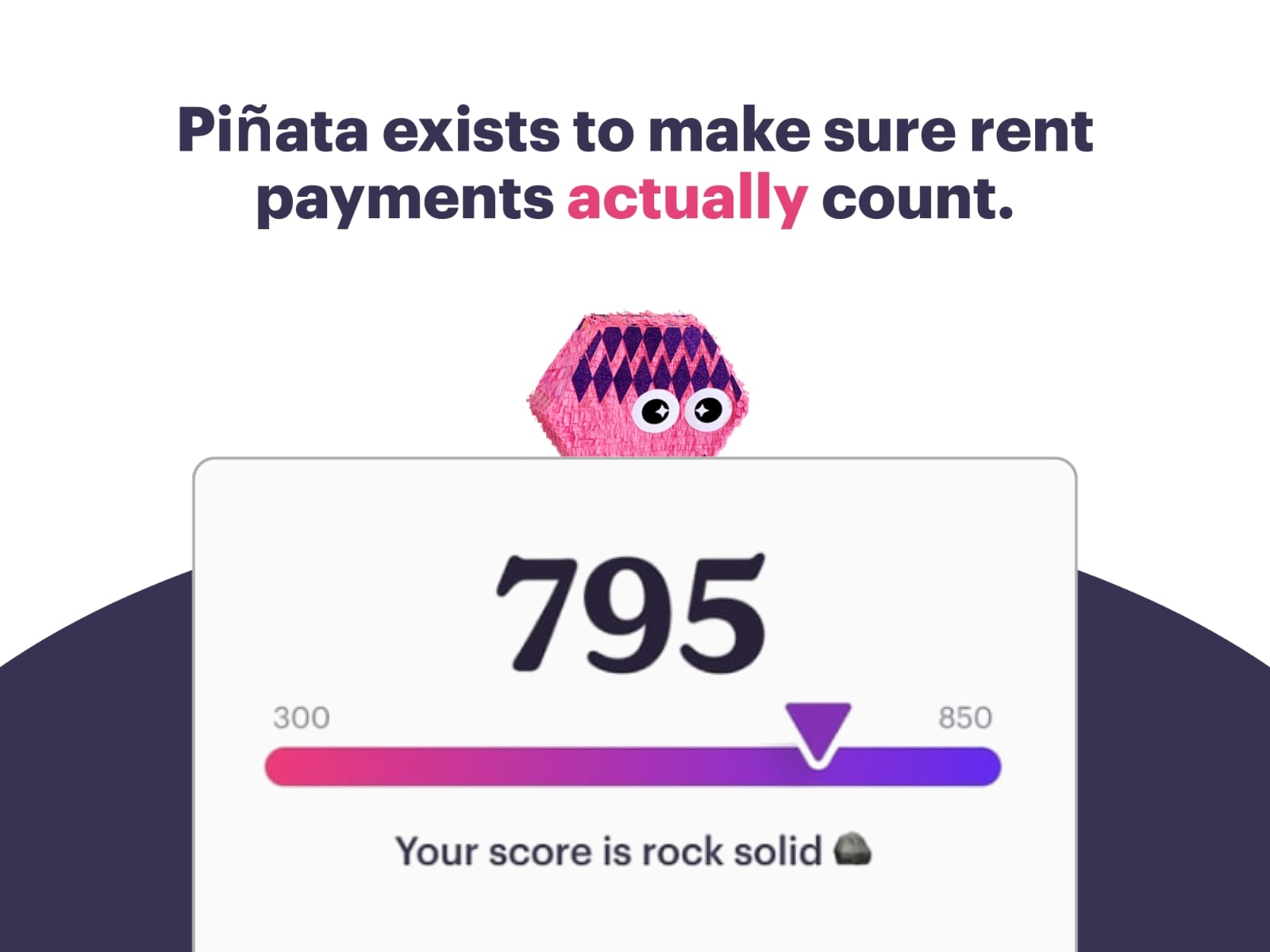

Piñata makes this easy. When you sign up through your landlord or property management company, back reporting is included in your membership. Don’t have that setup? No worries—you can sign up directly with Piñata for just $5/month.

Because your rent should do more than keep the lights on. It should open doors.